"Figures Don't Lie, But Liars..."

The headline reads, 'Most cars still cost more to charge than to fill up gas'

Byline: Bill Moore

I own a small, 2016 electric car. I recharge it at home, and home is in one of the US states with some of the cheapest rates of electricity in the country: 11.88 cent per kilowatt hour. (And fortunately, during parts of the year a fair share of that often comes from the wind). My experience is it's a LOT cheaper for me to drive my EV around town than even our hybrid.

So, I was a bit confused when I came across this headline stating, "Most cars still cost more to charge than to fill up with gas". Based on my personal experience, I don't understand how this can be true, especially if you do the math, which I have calculated for you below.

According to the Anderson Economy Group, they concluded, for example, "In the entry-priced segment, gas-powered cars were the most economical to fuel at around $9.78 per 100 purposeful miles," They found the same to supposedly be true for "Mid-priced and crossovers."

In the "Luxury-priced and crossovers, "electric vehicles charged mostly at home were the most economical. High-end EV drivers paid around $13.50 per 100 miles, as opposed to the $17.56 it would have cost to fuel a comparable ICE car." In the pickup truck category, gasoline and diesel fueling prices were comparable to those who charged with electric models at home.

Based on the Reagan-era philosophy of "trust but verify", I looked up some of the basic numbers one would use to reach such conclusions, relying on the "average" price of gasoline in the US at the moment ($3.80/gal), the "average" residential cost of electricity (16.18¢ /kWh) and the relative efficiency of a ICE vehicle vs a comparable electric model. Since the Insider article referenced the Porsche Taycan (a luxury-priced EV), I chose it for comparison with its ICE sibling the Cayene.

The Cayene reportedly gets 23 mpg in highway driving, so to travel 100 miles, it likely will consume over 4 gallons of fuel (4.34 to be more precise). At $3.80/gal, that 100 miles will run the owner $16.49. And how about the Taycan? According to a Google search, it will consume 45kWh of electricity to travel that same distance. Now assuming the driver charges at "home" using the national average electricity rate, their electric bill will see a bump of $7.26. Of course, if they live in Connecticut or California where residential rates hover at 30¢/kWh, the trip would cost $13.50; still less than the Cayene.

What about my "entry-priced" EV? With an EPA range of just 84 miles, I'd have to charge along the way to make up the additional 16 miles. Assuming I'd have to use a public charger, that would add a bit of the cost since public stations typically cost more than my home rate. Rates for public chargers are, honestly, all over the map, but - again - the "average" seems to be 20¢/kWh. I'd need about 5 more kilowatt hours to complete the 100 miles, so let's at $1; to the cost. My car has a 24 kWh battery: to charge it from 0-100% SOC would run $2.85 plus the added $1. So, figure I could, in theory, drive the 100 miles for less than $4.00. The gasoline twin of my car reportedly gets 30 mpg on highway and would burn 3.8 gallons to drive 100 miles. Gasoline cost for the trip? $14.44. Even if we assume using a public charger that can only meter "by the hour"...that might add $2 to my electricity cost; so figure $5.00 for the trip.

Now, granted electricity rates in other parts of the country, and for that matter, the world, can be a LOT higher than what we pay here on the American Great Plains. In the UK a trio of drivers in a hybrid, a plug-in hybrid and an EV simultaneously drove from London to the Midlands and back the same day. Then they drove across London the day following.The EV did cost more there, though it shined in the cross-London trip because it didn't have to pay the city's costly congestion charge, while the hybrids did.

So, my conclusion, based on my personal experience, is that my EV, in my part of the country, is WAY cheaper to charge than what the Anderson crew came up with. Of course, not included my calculation is the $75 fee I pay the state to compensate for not paying the state's gasoline excise charge. That would drive up my costs some. Your local rates and fees and taxes will impact your calculations, as well, so I suggest you run our own numbers, instead of accepting, at face value, their conclusions or mine.

Are Electric Vehicles Really More Expensive To Drive Than Gas?

First Published: 2023-08-02

Teslas Everywhere!

Sipping wine and counting cars in Woodinville

Byline: Bill Moore

A few days ago, my wife and I, along with our adult daughter, were sitting on the patio of the Gorman Winery Hollywood Hill tasting room on the roundabout at NE 145th and State Route 202 in Woodinville, Washington. The weather was beautiful, the temperature mild and the wine delicious. It was our second tasting stop of the afternoon, and as a precaution, our daughter was hiring Uber drivers to shuttle us between locations.

Apart from enjoying the setting and the fruit of the vine, I was struck by the sheer number of Tesla's cruising by. While I did spot a couple Rivian R1S and a Mustang Mach-e, it was the steady stream of Model 3's and Model Y's and even the rarer Model S that surprised me. Well, maybe 'surprise' isn't really the best term because since flying into SEATAC on the 19th, I couldn't help note the growing predominance of Tesla cars on the streets in and around the communities north of Seattle proper: Redmond, Lynnwood, Bothel, Mill Creek, Everett. Maybe its the influence of the prosperous tech industry surrounding the likes of Microsoft, Amazon, Boeing that allows more of the citizenry to afford the shift to Tesla. Since we started visiting our daughter, who took a job managing a biotech lab there some two years ago, I have noticed a pronounced increase in the diffusion of Musk's electric cars, at least in this part of the greater Seattle area where the company has a dealership in nearby Lynnwood.

On past trips I would point out, like a kid, every Tesla I spotted, that is until the wife and daughter chastised me with "Enough already." Now, in the summer of 2023, I have given up pointing them out. Honestly, they are everywhere! Chaste white seems to be the favored color, but you'll also see red, blue, black and gray. Yes, there are other EV makes and models: I even got to pull up next to a brand new Hyundai Ioniq 6 still sporting its transit sticker, but there's little question who has won the hearts, minds and wallets of drivers on the north side of Greater Seattle.

I live in Omaha, NE and we too are starting to see more Teslas, but for the sheer thrill of counting cars like a kid, give me that Gorman wine tasting room on the roundabout in Woodinville. The EV world can't get much better than this!

First Published: 2023-07-30

Nemaska Lithium: Holding a Piece of Its History

Quebec-based mining company wins contract with Ford Motor Company: It was a long time coming.

Byline: Bill Moore

I hold in my hand a small lump of rock with a green, crystalline tint. It was given to me years ago by the former CEO of Nemaska Lithium, Guy Bourassa. He had flown me to Toronto for the annual mining conference and then to Montreal to give a talk before a small group of potential investors, some of whom were from China and interested in processing the lithium found in the company's Whabouchi mine project in Quebec. What I held was a chip from one of its many sample drilling cores.

After that trip, we gradually lost touch, though I'd occasionally find an press release pop up in my email inbox. It was the announcement this week that Ford Motor Company has contracted with Nemaska for 17,000 tons of lithium hydroxide annually that spurred me to pull that chunk of greenish rock out of my desk draw and search the 'Net for Guy's name, which I had subsequently forgotten.

According to a 2020 article on Mining.com, Guy was forced out of the company, which was then deeply in debt and going through a restructuring "under the supervision of the Superior Court of Quebec and PricewaterhouseCoopers, as monitor of its business and financial affairs". The Nemaska Lithium website lists a management team, most of whom came on board in 2020 when it was acquired by the Pallinghurst Group and Livent. In the intervening years, the company proceeded to develop the Whabouchi mine and its Becancour processing plant on which Nemaska began clearing land in January of this year. Presumably, while the plant is under construction, and according to their press release, the company will supply unprocessed spodumene (the green crystalline material in the above stone).

Like the tiny lump of reddish clay from the original Chevrolet Volt concept model and the sample Volt battery pouch on top of my bookshelf, holding that bit of rock reminds me of the privilege Ive had to be a part of the transition to an EV world. Here's wishing Nemaska and Ford both much success. It's been a long time coming.

And Guy, thank you for your vision and letting me share in your journey, if only briefly!

First Published: 2023-05-23

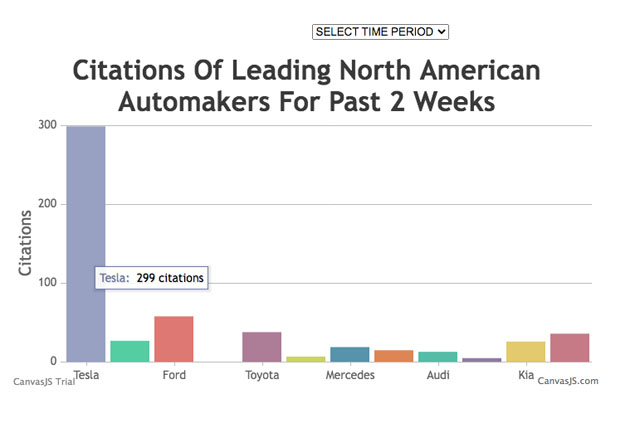

Graphing the World of Electric Vehicle Headlines

New EVWorld.com feature displays the latest news trends in bar chart format.

Byline: Bill Moore

Back a year ago, EV World© relaunched with a new platform and mission: curate technical, political and social developments in the world of electric vehicles on a global basis: at least whose we could find on English language platforms on the Internet. These currently include established publications like the New York Times, The Guardian, Washington Post, The Sun, Fox News, Forbes, Khaleejtimes, Car&Driver, Belfast Live, Montreal Gazette, Economist, 24/7 Wallstreet, Aljazeera, All Africa, Livemint, Bloomberg, Motley Fool, AP News…well over 900, likely more! Additionally, a sizable number of automotive and electric vehicle-specific websites also contribute to the daily flood of scores of reports: Electrek, Greencar Reports, Teslarati, Motor1, just to mention a few. It's a tedious but edifying process that takes me, personally, many hours every day, seven days a week for the last year. At this writing there are some 35,000 entries in the RSS database since its creation late last April 2022, and from which the numbers behind the charts are generated.

It didn't take a 2x4 up the side of my head to notice certain trends in the reporting, the most obvious being that Tesla and Elon Musk clearly dominate media thinking and reporting, so much so that I had to figure how to visualize its reality for my own satisfaction. It was then the idea came to create Trending section on the website. Some simple backend SQL coding tied to a nifty javascript charting API I found online allowed me to compare, for example, how often a carmaker's name appeared in a news story headline. Once I finally got it working (I am relatively new to PHP), the visual results where stunning, as the above screen capture illustrates. In the past two weeks, for example, there were 279 references to Tesla, while GM (General Motors) garnered 27 and Ford elicited over twice as many at 58. Toyota (38) and Hyundai (36) nearly tied. Kia beat out Mercedes, Audi and Volkswagen. Honda got zero mentions. In China, BYD is the clear leader. Among the more recent North America EV startups, Rivian dominates, but still only manages 26 citations over the same two week period: Trending's default time frame. You can select other time periods: the past 24 hours, the past week, the past month, the past year. Maybe not all that surprisingly, the results tend not to change all that much. The most recent flurry of reports on the EPA's proposed new - and much tougher - emissions rules for cars and trucks, has pushed up the numbers in the "Policy" category.

Because I am the one cataloging all the stories I curate, there is some obvious subjectivity to the selection process. First off, I curate as many stories as I can find, typically anywhere from 50 or so daily and frequently two and three times that number. The stories tend to not only be focused on electric mobility of pretty much any shape and size: e-bikes and tuktuks; light cars and heavy trucks; ferries and motorboats; electric passenger aircraft and evolving VTOLs; even the amazing, solar-powered Ingenuity helicopter on Mars gets a link. BTW, it just completed its 50th flight on the Red Planet. Besides the technology, I look for stories about the politics the drives debate around the technology, securing needed minerals, tax policy, financial incentives, environmental conerns over climate change, sealevel rise, energy production, battery recycling, urban planning.

Categorizing stories can be challenging. A reference to production at Tesla's Berlin Gigafactory seems straight-forward. Region: Europe; sector impacted: Commercial; category: Finance...OR should it be "Mobility"? If financial numbers are mentioned, I usually choose "financial", but if government permitting issues are raised, it goes under "Policy" and it the story references something like "gigapress" it might fall under the "Mobility" classification.

I should hasten to note that because some automakers produce several different brands - General Motors and China's SAIC, for example - those firm's sub-brands may not appear in the statistics behind the chart. If the headline doesn't also include "GM" in a story about the Chevy Bolt, that story will NOT be included in the statistics that drive the North American OEM chart. I wlll have to create a separate chart to catch those trends: "Citations About GM Sub-Brands" - Chevy, Cadillac, Buick, GMC (Hummer), etc.

Now that Trending is up and running with seven different bar charts, I hope that you, dear reader, will find them of interest. They seem to reveal trends I - and quite possibly you - may have long suspected. I'll look for other opportunities to mine the growing lode of information stored in EVWorld's database and share them with you. Thanks for reading along... and please think about becoming a Patreon supporter.

First Published: 2022-04-15

Wright's Law, Affordable EVs and Driving the "Poor"

In answer to Senator Mitt "Let them ride mass transit" Romney

Byline: Bill Moore

My wife, who is always ready to not have to cook on the weekend, suggested we dine out at Lil' Burro, our favorite Tex-Mex restaurant, a short drive east on Capehart Road. Our timing was perfect as we arrived moments before the lobby jammed with other parties inspired by the same notion and the good food that comes out of the kitchen.

We've known the owner for years and despite it being a busy Saturday night, he took time to stop by and chat, starting with asking me about my experiences with aquaponics. For some three years, I'd run a small basement system, raising lettuce, Swiss chard, kale, even a largely abortive experiment with strawberries, all grown under grow lights. The fish of choice was largemouth bass, acquired as fingerlings. Their waste provided the nutrients for the vegetables, which, in turn, cleaned up the water that was recycled back into the fish tank, a 100 gallon livestock tank.

It was a fun experience, but in the end, I concluded it needed to be outdoors in a greenhouse-type setup. The owner was interested because he wanted to find a way to sustainably source his produce…and tilapia…locally, instead of depending on it coming from California, Arizona and Mexico.

That, of course, led to a conversation about electric vehicles and his skepticism about their practicality and costs (he's also a car collectors with the penchant for old Volvos), especially the expanding bans on the sale of internal combustion engines spreading steadily - if somewhat in fits and starts - around the globe. He also wondered about all the diesel-burning, giant mine trucks needed to haul lithium: the same trucks used to mine copper and tar sands, I might add. But mainly, he didn't think it far to make everyone give up their fossil fuel cars and trucks for expensive electric ones. How will the poor afford them, he asked?

At the time, I was not aware of "Wright's Law" . That revelation would come the next day! Instead, I asked him what a cellphone cost originally or a flat-screen television set when they first came out. He guessed maybe a $1000. Of course they cost much more than that. In 1999, the first flat-screen TV cost $8K, equivalent in today's dollars to $11,186! The first cellphone came out around 1980. They cost $3995. In 2023 dollars that's $14,585.00!

Now cellphones still can cost close to $1000, but they are infinitely more capable than their 1980 ancestors. The same is true of a modern flat-screen TV and they don't cost more than $14K! Why? Because of Wright's Law, which Clean Technica defines thus: "Wright's Law states that the price of production for a given product will go down a fixed amount...every time the cumulative number of units doubles."

It is Wright's Law that has the likes of GM, Ford, Volkswagen, and others scrambling for their lives, because not only is Tesla a decade ahead of them technologically (just watch some of Sandy Munro's Live shows on Youtube, "boys and girls"), as well as in terms of production costs and profit margins. The Chinese aren't that far behind and like the Japanese and South Koreans before them, they will eventually establish "beachheads" in the USA, likely through US-sited factories for batteries and cars (again listen to Sandy Munro's warnings) as a result of Joe Biden's onshoring policies.

Now, we know VW is planning to introduce a $25K EV… as, presumably, is Tesla, and we'll likely see similar offerings from others. Of course, the more EVs that get built, but more raw materials are needed and we still haven't really addressed traffic congestion or the consequences of a system too dependent on private automobile ownership. Frankly, not everyone needs to own a car for both economic and health reasons: the Dutch and the Danes demonstrate that. With better, safer bike lanes, a lot of people would willingly abandon the expense of owning and operating a personal car, gas or electric. But it seems the "Grand Oil Party" is dead opposed to encouraging that avenue to sustainability, Republican Senator Mitt Romney calling cycling advocates' efforts to replace car lanes with bike lanes, "the height of stupidity." He similarly opposes a Democratic Party bill to subsidize the sale of electric-assist bicycles, saying those who can't afford cars should take mass transit." Easy for a multi-millionaire to say!

My point is that between Wright's Law and the encouragement and development of micro-mobility systems - including dedicated bike lanes and even Indian-style motorcycle taxis - along with autonomous shuttles … the "poor" won't be left behind in the transition to a world where "all cars are green, bicycles rule and public transit is fast, frequent and fun."

First Published: 2022-04-03

MY PERSPECTIVE

My views are my own... but I can be persuaded by the facts

SUPPORT EVWORLD

Become a patron and help spread the good news of the world of electric vehicles.

Newsletter

Not yet ready for primetime.

© EVWORLD.COM. All Rights Reserved. Design by HTML Codex